On Thursday, June 9th, the IRS announced an increase in the optional standard mileage rate for the last 6 months of 2022. This is in recognition of the pain Americans are feeling at the pump due to recent gasoline price increases.

Generally, taxpayers have the option to use actual costs of using their vehicle or use the standard mileage rates.

This mid-year rate hike is fairly historic, as the last time the IRS issued a mid-year increase was in 2011. Typically, rates are adjusted annually based on macroeconomic trends.

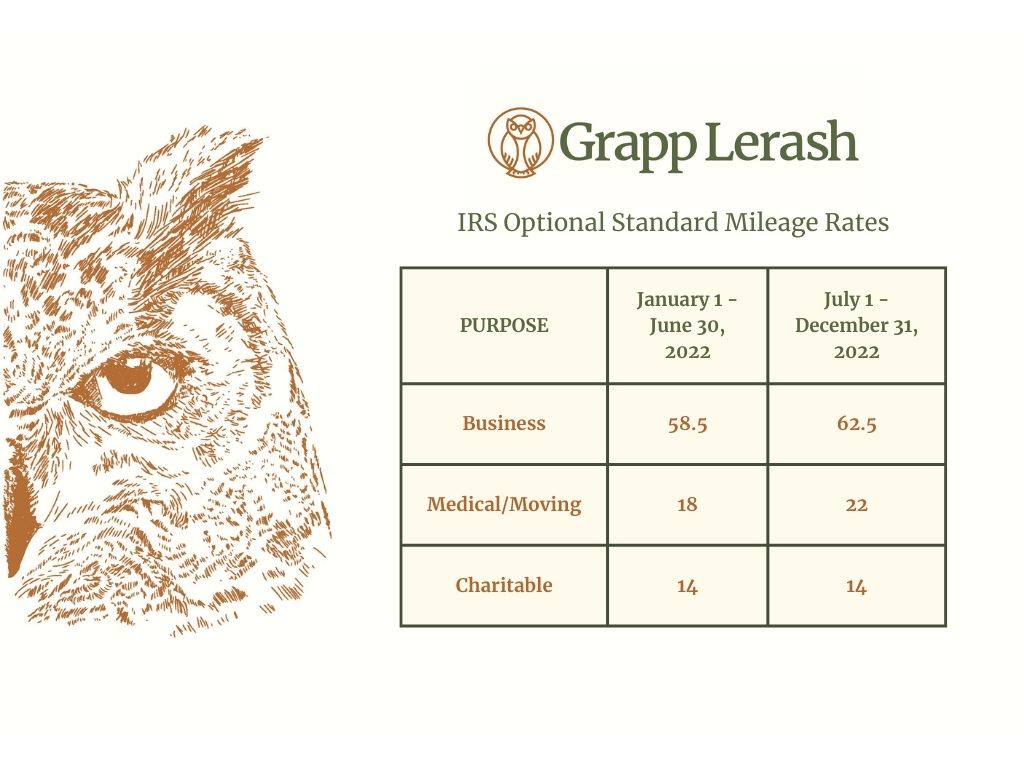

Effective July 1st, the standard mileage rate for business travel will be 62.5 cents per mile. This is an increase of 4 cents from the rate currently in effect until the end of June, which is at a rate of 58.5 cents per mile. This increase is significant as the standard rate is typically the benchmark by which eligible taxpayers deduct mileage on their returns, as well as how businesses typically compensate employees for business-purpose travel.

You can read the full text of the IRS announcement here.

We always encourage you to reach out to your Grapp Lerash advisor with any questions or concerns. We’ve provided the table below for ease of reference.

Recent Comments